Get the free ospra 102 form - stamfordcs

Show details

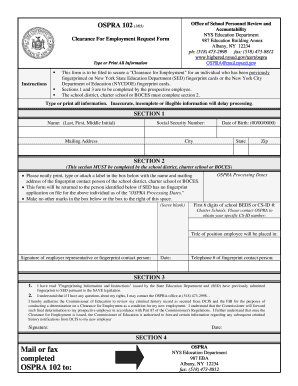

OS PRA 102 (1/03) Clearance For Employment Request Form Type or Print All Information Office of School Personnel Review and Accountability NYS Education Department 987 Education Building Annex Albany,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ospra 102 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ospra 102 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ospra 102 form - online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ospra 102 form -. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out ospra 102 form

How to fill out ospra 102 form:

01

Start by gathering all the necessary information and documents required for the form, such as personal identification details, employment history, and any relevant supporting documents.

02

Carefully read through the instructions provided on the form to understand the specific requirements and guidelines for filling out each section.

03

Begin by filling out the personal information section, including your name, address, contact information, and social security number.

04

Move on to the employment history section and provide details of your previous employment, including the name of the organization, the position held, the period of employment, and any relevant details.

05

If applicable, provide any additional information or documentation required for specific sections of the form, such as attachments or references.

06

Review the completed form to ensure all information is accurate and complete. Make any necessary corrections or additions before submitting.

07

Sign and date the form as required, acknowledging that the information provided is truthful and accurate.

Who needs ospra 102 form:

01

Employees who are applying for a position that requires a background check or security clearance may need to fill out the ospra 102 form.

02

Employers or organizations that require background checks or security clearances for their employees may also ask their employees to fill out the ospra 102 form.

03

In some cases, individuals seeking professional certifications or licenses that require a background check may need to complete the ospra 102 form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ospra 102 form?

The "OSPIRA 102 form" is actually called the "Standard Form 102: Reporting Non-Taxable Fringe Benefits." This form is used by employers to report certain fringe benefits provided to their employees, which are not subject to federal income tax withholding. These fringe benefits may include items like health insurance premiums, group-term life insurance, and certain educational assistance programs. The purpose of the form is to document and report these non-taxable benefits accurately.

Who is required to file ospra 102 form?

OSHA Form 102, also known as the OSHA Summary of Work-Related Injuries and Illnesses, is required to be filed by employers who are subject to the recordkeeping requirements of the Occupational Safety and Health Administration (OSHA). This includes employers with more than 10 employees in most industries, except for certain low-risk industries.

How to fill out ospra 102 form?

To fill out the OSPRA 102 form, you can follow these steps:

1. Review the instructions: Before starting the form, read through the instructions provided by your organization or the agency that requires the OSPRA 102 form. This will help you understand the specific requirements and any additional documents needed.

2. Download the form: Obtain the OSPRA 102 form from the official website of your state's Department of Health or the relevant regulatory agency.

3. Provide your personal information: Begin by providing your personal details, such as your full name, address, contact information, Social Security number, and date of birth. Ensure that the information provided is accurate and up to date.

4. Include your work history: Provide a comprehensive list of your previous employment history. This may include the name of the employer, job title, dates of employment, and whether the position involved working with children or vulnerable individuals.

5. Disclose any previous convictions: If you have any criminal convictions, you need to disclose them in this section. Include the nature of the offense, date of conviction, and any relevant details. Be honest and accurate while providing this information.

6. Provide references: The OSPRA 102 form typically requires you to provide references who can vouch for your character and suitability for working with children or vulnerable individuals. Include their names, contact information, and their relationship to you.

7. Signature and certification: Sign and date the form, certifying that the information provided is true and accurate to the best of your knowledge.

8. Attach any necessary documents: Depending on the specific requirements, you may need to attach additional documents such as copies of your identification, certifications, or other requested materials. Ensure that you include all the required documents before submitting the form.

9. Submit the form: Once the form is completed and all necessary documents are attached, submit it to the appropriate agency or organization as instructed. Follow any additional guidelines provided, such as submitting online, mailing, or hand-delivering the form.

Remember to keep a copy of the completed form and any supporting documents for your records.

What is the purpose of ospra 102 form?

The purpose of the OSPRA 102 form, also known as the New York State Education Department Office of School Personnel Review and Accountability form, is to conduct a comprehensive background check on individuals applying for positions in New York State schools. This form is used to collect information about the applicant's personal and employment history, including any criminal records or incidents of misconduct. The OSPRA 102 form helps ensure the safety and well-being of students by screening potential employees and preventing the hiring of individuals who may pose a risk to the school community.

What information must be reported on ospra 102 form?

The OSRPA 102 form, also known as the Public Employee Reporting Act form, typically requires the following information to be reported:

1. Basic Information: The form requires the name, position, and salary of the public employee who is required to file the form.

2. Financial Interests: The form requires the reporting of any sources of income, assets, or financial interests held by the public employee, their spouse, or their dependent children. This includes income from employment, investments, businesses, rental properties, and other sources.

3. Gifts, Loans, and Travel: Any gifts, loans, or reimbursements exceeding a certain value, provided to the public employee, their spouse, or dependent children, must be reported. Additionally, any travel expenses paid by a third party, if not directly related to official government business, should also be disclosed.

4. Outside Employment and Business Activities: Public employees must disclose any outside employment, directorships, partnerships, or other business activities they are engaged in, including the name of the employer or business entity.

5. Interested Parties: If the public employee or their spouse has any financial interests in entities that conduct business with the government agency, contracts exceeding a certain value, or lease agreements must be disclosed.

It is important to note that the specific information required may vary depending on the jurisdiction and the agency for which the public employee works. Therefore, it is essential to consult the applicable regulations and guidelines for accurate reporting on the OSRPA 102 form.

What is the penalty for the late filing of ospra 102 form?

The penalties for the late filing of the OSPRA 102 form, which is a New York State requirement for certain public contracts, can vary depending on the specific circumstances and the discretion of the enforcing agency. Generally, late filing may result in the imposition of fines, late fees, or contractual penalties. However, without specific details about the contract, it is difficult to provide an exact penalty amount. It is advisable to consult the applicable statutes, regulations, or the enforcing agency for more accurate information on penalties for late filing in your particular case.

How can I modify ospra 102 form - without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like ospra 102 form -, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit ospra 102 form - straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing ospra 102 form -.

How do I edit ospra 102 form - on an Android device?

You can edit, sign, and distribute ospra 102 form - on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your ospra 102 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.